35+ pros and cons of reverse mortgages

They can provide a source of emergency funds or income. The list of cons exceeds the pros.

The Pros And Cons Of Reverse Mortgages

Web What Are The Pros And Cons Of A Reverse Mortgage Doug Andrew - 3 Dimensional Wealth 791K subscribers Subscribe 417 11K views 1 year ago RetirementFund.

. A reverse mortgage is a loan option that can help make it easier for homeowners and homebuyers age 62 and older to live a more comfortable. Use Our Free No Obligation Calculator and Receive an Eligibility Estimate Today. You can spend the money how you like.

Web Reverse mortgages particularly the line of credit payment plan can also be helpful in many situations. Ad Take Our Suitability Test and find out if a Reverse Mortgage is the Right Choice. Pay down debt or fund home improvements travel medical treatment or even use it.

Taking out a reverse mortgage is a big financial decision so its important to consider both the pros and cons before. Web The reverse mortgage is a relatively new loan product compared to conventional loans and FHA loans that have been around for many decades. Web Reverse mortgages have several advantages that can make them attractive to homeowners.

Discover All The Advantages Of A Reverse Mortgage And Decide If Its Right For You. Many options fit the different needs of borrowers. Compare the Best Reverse Mortgage Lenders In The Nation.

Instantly estimate your reverse mortgage loan amount with the Reverse Mortgage Calculator. Pros and cons of a reverse mortgage. Get Free Info Now.

With regular mortgages borrowers make monthly. Web Other risks include. Your loan gets bigger over time.

Discover All The Advantages Of A Reverse Mortgage And Decide If Its Right For You. Is it right for you now. Compare a Reverse Mortgage with Traditional Home Equity Loans.

Web Pros and cons of reverse mortgages Pros More cash in retirement. After a lifetime of building equity your use of a reverse mortgage will likely start drawing down your equity. Heres a summary of the pros and.

Check Out the Best Lenders. Web PROS of a Reverse Mortgage. You may also be on the hook for monthly loan servicing fees that top out at 30 for fixed.

Web Types of reverse mortgages. Web Reverse mortgages can significantly increase the amount of debt you carry which can result in you having less to leave to your family or other benefactors of your. But if youre using your.

Ad Save Time and Choose the Right Home Equity Offer for You. Interest service fees and mortgage insurance will all be assessed and added to the loan. However it is critical that a.

Web The pros of a reverse mortgage include. Compare the Best Reverse Mortgage Lenders In The Nation. Web Pros and Cons of Reverse Mortgages.

Apply for the Best Home Equity Loan With Our Exclusive Rates See Offers from Top Lenders. Ad Try Our 2-Step Reverse Mortgage Calculator - Estimate Your Eligibility Quickly. Web A reverse mortgage is a type of home loan that lets you convert a portion of the equity in your house into cash.

Web Up to 25 cash back But for most people getting a reverse mortgage is a bad idea. They will never be mentioned in any sales pitch or advertisement. Web The pros of a reverse mortgage include.

Web Reverse mortgages can be a stream of income a lump sum or a line of credit. Ad Understand the Pros Cons of Reverse Mortgages. Ad If Youre 62 Or Older A Reverse Mortgage Loan May Be Right For You.

The money is tax-free. Here are the primary reasons to consider using them. Web Reverse mortgage pros and cons While a reverse mortgage can provide various benefits it also has a few potential drawbacks.

Web Pros of a reverse mortgage in Canada. Ad Can the loan improve your emotional and financial well being. Ad Understand the Pros Cons of Reverse Mortgages.

Reverse mortgages also have a lot of negative points associated with them. You could access up to 55 of the equity from your home tax-free without having to make monthly mortgage payments. Get Free Info Now.

You lose tax breaks. Web While a reverse mortgage feels like free money its actually a loan. You can spend the money how you like.

Interest paid on reverse mortgage loans is not tax deductible even in part the way interest on a traditional mortgage is. Pay down debt or fund home improvements travel medical treatment or even. Payments from a reverse mortgage can be useful if your retirement savings and Social Security checks.

Ad If Youre 62 Or Older A Reverse Mortgage Loan May Be Right For You. Youre drawing down your equity.

Reverse Mortgage Pros And Cons For Homeowners

Big Drop In Home Sales Surging Mortgage Rates Tight Supply The New Dynamics Shaping Up Wolf Street

![]()

Reverse Mortgage Disadvantages And Advantages Your Guide To Reverse Mortgage Pros And Cons Newretirement

The Pros Cons Of Mortgage Loans Loan Advantages Rmf

Mpa 22 06 By Key Media Issuu

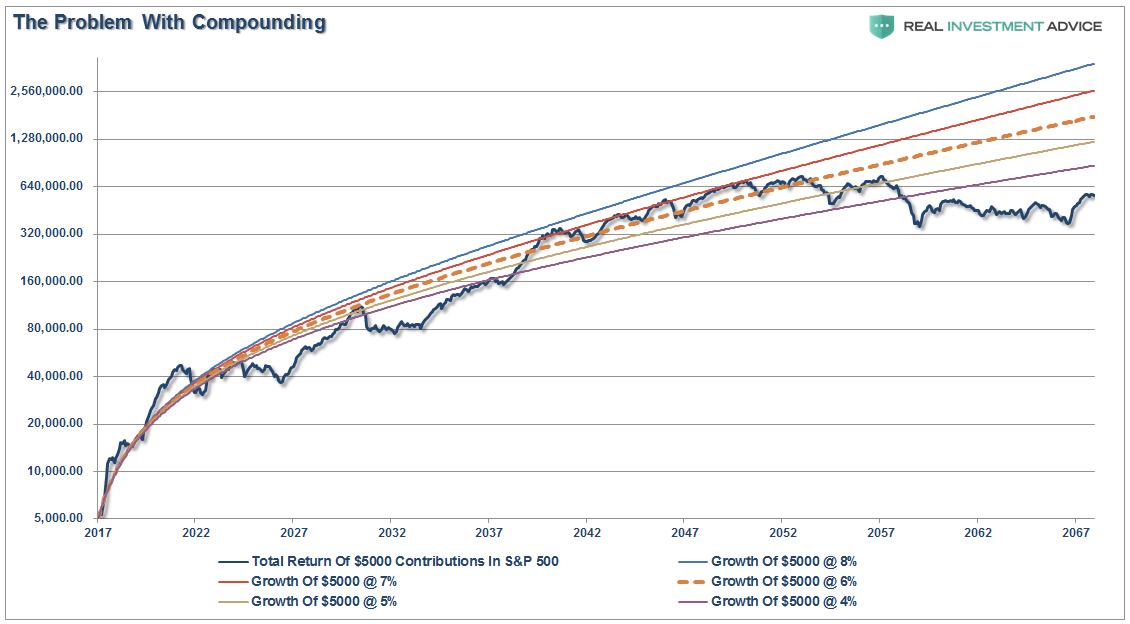

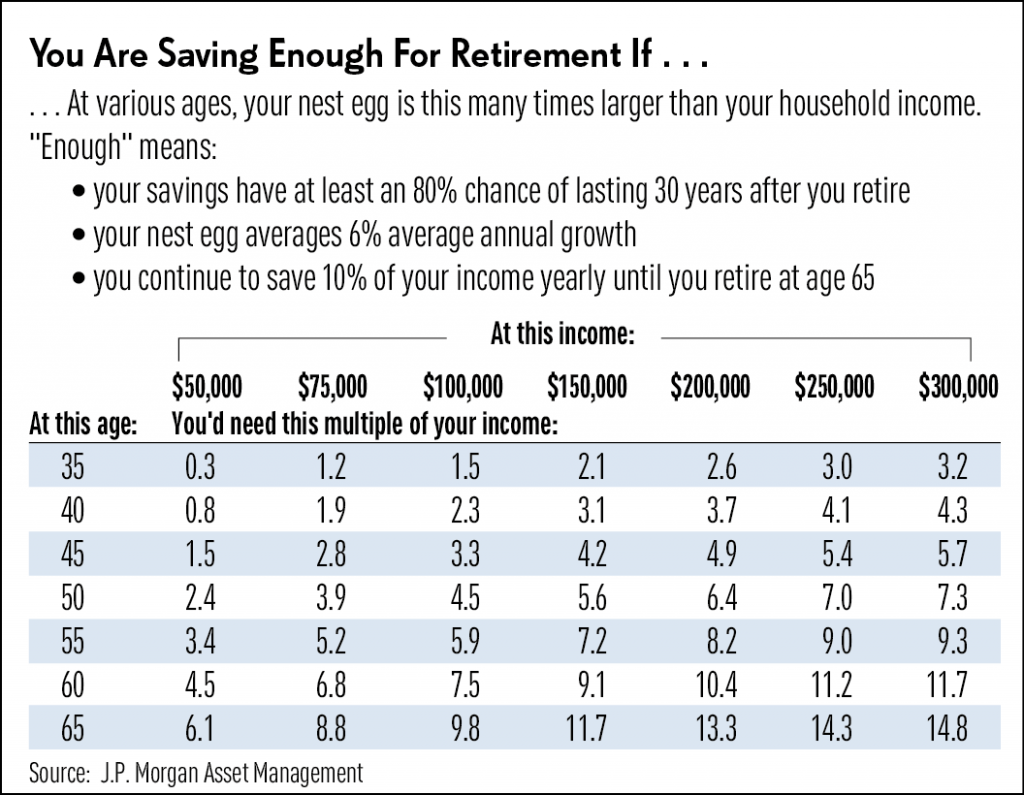

Boomers Are Facing A Financial Crisis Seeking Alpha

What Is A Reverse Mortgage Pros And Cons Explained

Reverse Mortgage Pros And Cons Bankrate

Boomers Are Facing A Financial Crisis Seeking Alpha

Reference Material Florida State Board Of Administration

Reverse Mortgage Pros And Cons

How Canada S Mortgage Lenders Adapted To The New Normal Mortgage Rates Mortgage Broker News In Canada

Top 13 Pros Cons Of Reverse Mortgages

Big Drop In Home Sales Surging Mortgage Rates Tight Supply The New Dynamics Shaping Up Wolf Street

Reverse Mortgage Pros Cons Starting With The Negatives

Types Of Reverse Mortgages Differences Pros Cons And Risks

Most Banks Move To 30 Year Conventional Amortizations Mortgage Rates Mortgage Broker News In Canada